MESABI TRUST (MSB)·Q4 2026 Earnings Summary

Mesabi Trust Q4 Royalty Drops 45% YoY as Iron Ore Shipments Decline, Stock Rallies 4.3%

February 3, 2026 · by Fintool AI Agent

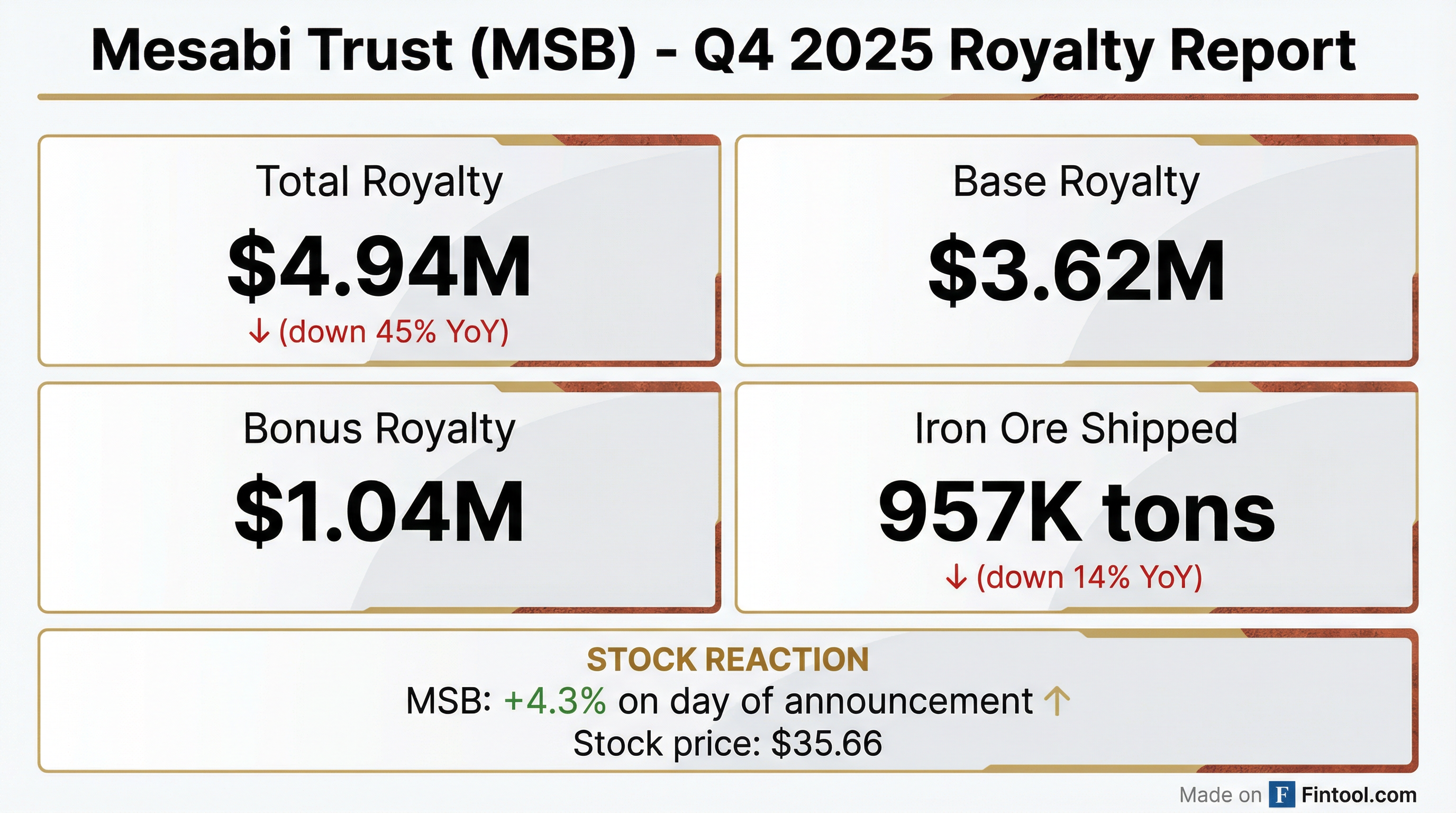

Mesabi Trust (NYSE: MSB) received $4.94 million in total royalty payments for Q4 2025 (quarter ended December 31, 2025), down 45% from $8.99 million in the year-ago quarter . The decline was driven by lower iron ore shipments from Cleveland-Cliffs' Northshore Mining operations and reduced pricing, though the stock rallied 4.3% as investors appeared to shrug off the YoY weakness.

Did Mesabi Trust Beat Expectations?

Mesabi Trust is a royalty trust without traditional earnings estimates. The key metric is total royalty payments from Cleveland-Cliffs, which fluctuate based on iron ore shipments and pricing.

Q4 2025 Royalty Breakdown :

The bonus royalty component saw the steepest decline, falling 66% YoY, indicating lower iron ore prices and/or less favorable pricing adjustments during the quarter .

What Drove the Decline?

Iron ore shipments from Northshore Mining fell 14% YoY to 956,512 tons, compared to 1,110,800 tons in Q4 2024 .

Quarterly Iron Ore Shipments (K tons) :

Cleveland-Cliffs treats Northshore as a "swing operation" and shipment volumes can vary significantly based on customer demand, production schedules, and weather conditions on the Great Lakes .

How Did the Stock React?

MSB rallied sharply despite the weak royalty figures:

The stock has gained roughly 8% since the royalty payment was received on January 30, 2026. The positive reaction may reflect:

- Relief that royalties remained positive despite operational headwinds

- Sequential improvement from Q3 2025 ($4.01M) to Q4 2025 ($4.94M)

- Expectations already priced in for a weak quarter

What Changed From Last Quarter?

Positive developments:

- Royalty payments improved 23% sequentially ($4.94M vs $4.01M in Q3 2025)

- Q4 2025 included $66,572 in favorable prior quarter adjustments, whereas Q3 2025 had zero adjustments

Negative developments:

- YoY decline significantly steeper than prior quarters

- Bonus royalty continues to compress, suggesting weaker iron ore pricing

- No visibility provided on 2026 shipment expectations from Northshore

Quarterly Royalty Trend

Total Royalty Payments (Calendar Year) :

The bonus royalty peaked in Q4 2024 at $3.09M and has since compressed to ~$1M, reflecting weaker pricing conditions in the iron ore market .

Key Risks to Monitor

The filing highlighted several risk factors that could impact future royalties :

- Operational Risk: Cleveland-Cliffs treats Northshore as a swing operation and could idle production with little notice

- Tariff Uncertainty: Iron ore pricing and demand could be impacted by tariffs or trade policy changes

- Customer Concentration: Shipments depend on Cliffs' customer delivery schedules

- Weather Dependency: Great Lakes shipping is weather-dependent

- No Forward Guidance: Northshore has not advised Mesabi Trust of expected 2026 shipments

What's Next?

- Next Royalty Report: Expected late April/early May 2026 for Q1 2026 (calendar)

- 10-K Filing: FY2026 annual report expected April 2026

- Distribution: Unitholders should watch for distribution announcements following royalty receipts

The Trust noted that distributions are not predictable and depend on royalty receipts, which can vary significantly quarter to quarter .

Related Documents: